By Richard G. Thissen – July 20, 2016

By Richard G. Thissen – July 20, 2016

When people think of the U.S. Postal Service’s finances, if they even do, they worry about the impact on their magazine delivery or the spoils of their late night shopping habit. I know I worry about these things. But another, less noticeable part of the debate over the financial health of our nation’s postal service will have serious consequences for postal workers and retirees.

Legislation recently approved by a House committee reforming the U.S. Postal Service (USPS) targets postal retirees to balance the Postal Service’s books, and it does so in the name of bipartisanship and expediency, usually good things. Not this time. Specifically, it breaks a promise made to now-retired postal workers and their survivors regarding their health benefits. It tells them they now must pay additional health insurance premiums for more, mostly duplicative, insurance coverage through Medicare or risk losing their health insurance benefits entirely.

Legislation recently approved by a House committee reforming the U.S. Postal Service (USPS) targets postal retirees to balance the Postal Service’s books, and it does so in the name of bipartisanship and expediency, usually good things. Not this time. Specifically, it breaks a promise made to now-retired postal workers and their survivors regarding their health benefits. It tells them they now must pay additional health insurance premiums for more, mostly duplicative, insurance coverage through Medicare or risk losing their health insurance benefits entirely.

For postal retirees and survivors who are satisfied with their current coverage, that means another $122 per month or more to keep their current health insurance. This flies in the face of fairness and changes the rules for individuals who do not have the ability to increase their income.

Why is Congress forcing this additional cost on postal retirees and their survivors? The answer is unconvincing. The proposal has support because the current system, in which postal retirees have the option of declining Medicare and keeping their current health insurance does not save quite as much money for USPS.

Why is this the only path forward? Why not allow USPS to raise the price of a stamp to a more reasonable amount, instead of continuing to heavily subsidize the business of bulk mailers? Why not allow USPS to ship alcohol or provide more financial services? Why not allow USPS to pay its health insurance bills when they are due, and not before, by ending the burdensome prefunding requirement?

These are the questions members of Congress should ask themselves (and that voters should ask them) before they place the burden of postal reform on the backs of postal retirees and their survivors. These retirees should not now, after finishing long careers with the Postal Service, be threatened with the loss of their health insurance entirely if they do not buy additional coverage. This is not only unfair to postal retirees, but it also sets a dangerous precedent for all federal retirees.

Supporters of the proposal will say that having both federal retiree health insurance and Medicare is a better bet for postal retirees, and most already make that choice. It is true that having dual coverage is more comprehensive and can save individuals more in reduced deductibles and co-pays in the long term than they pay in additional premiums.

But it’s not a one-size-fits-all situation. Some individuals are quite happy with the decision they made and the insurance they have now. They neither want – nor can they afford – to pay another $122 per month. The bargain struck with postal retirees left that decision up to them, and it should remain that way for current retirees.

Supporters also argue that private-sector companies that provide retiree health benefits Medicare enrollment as a condition of receiving require health benefits. So, why shouldn’t USPS do the same thing?

That might be a valid argument if the postal reform bill required Medicare enrollment but priced retiree health insurance as the supplemental benefit it then becomes, as private-sector companies do. But the postal reform bill requires Medicare enrollment and continues to keep retiree health insurance premiums at the full price.

In the end, the postal reform bill would create significant savings for USPS through “Medicare integration,” as supporters like to call it. We call it reneging on promises and augmenting the finances of the Postal Service at the expense of its retirees. When there are a number of other paths to get the Postal Service to solvency, why choose the one that picks the pockets of its retirees? Political expediency is not a good enough answer. This bill should be rejected.

Richard G. Thissen is president of the National Active and Retired Federal Employees Association.

Source: The Hill

Union and NAME of Local/Branch

APWU Springfield, MA Area local and Postal Retiree

Office held, if any

Past President

It is important that all Postal Retirees keep up pressure on their Congressional Representatives and Senator’s to get changes made to this bill. Your action will add to, and increase efforts by national organizations to change this bill. I have the basic Blue Cross/Blue Shield health plan. It works for me and my wife. I was told at my local NARFE meeting that most have the high option plan. That’s good for them. I don’t choose to do what most members do, and I want to keep it that way! It’s got nothing to do with “hardship.” It’s choice, pure and simple.

Union and NAME of Local/Branch

APWU - Auburn WA Local

Office held, if any

Retired President

The 2016 Medicare Trustees Report tells us that Part B premiums are expected to rise in 2017 to $149/month, up from $121.80 in 2016 and $104.90 in 2015. They predict the Medicare trust fund will go broke in 12 years, largely due to 10,000 baby boomers reaching age 65 every day. Does it make sense to move postal retirees into a bankrupt Medicare system as proposed in the latest postal reform bill?

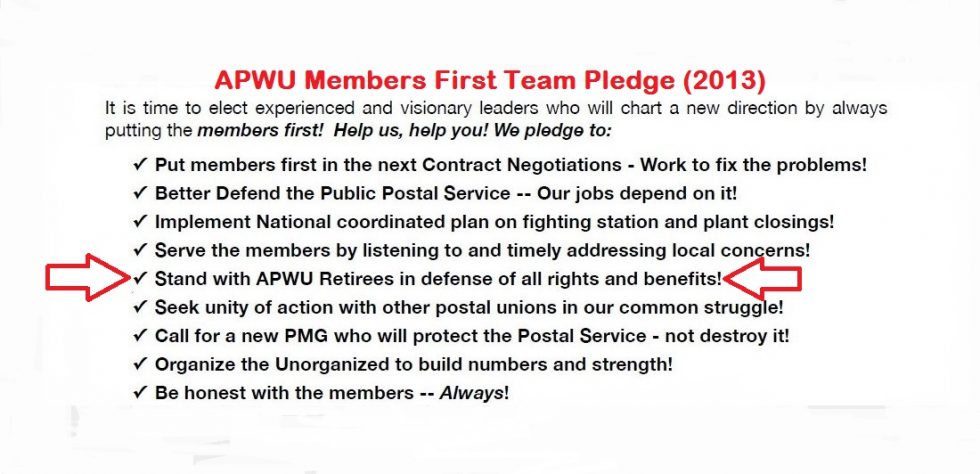

Don Cheney for Retiree National Convention Delegate – Western Region