By Melanie Trottman – February 20, 2015

By Melanie Trottman – February 20, 2015

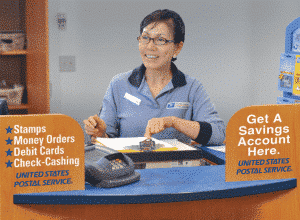

The American Postal Workers Union is making a big ask as part of contract talks it kicked off Thursday with the U.S. Postal Service: It wants the post office to expand customer offerings to include financial services.

That will be a challenge. The recently departed postmaster general, Patrick R. Donahoe, said postal banking doesn’t seem needed or feasible. Instead, he recommended focusing on building the agency’s package delivery service for e-commerce companies like Amazon.com, as traditional first-class mail volumes have fallen by more than 20% since 2009. The union, which is also proposing to extend operating hours at post offices, is hoping new Postmaster General Megan Brennan will consider other ideas.

“We’re very serious about the post office taking on financial services. The post office is trusted, it’s in every community, the workers are skilled and trained,” said the union’s President Mark Dimondstein, who spoke at a press conference in Washington Thursday to mark the start of negotiations where the union made its general opening remarks to management.

Mr. Dimondstein said cuts and closures to the Postal Service have eliminated tens of thousands of “good, living wage jobs.”

“Postal management’s policy has been to severely degrade service, dismantle the postal network, and engage in piecemeal privatization,” he said. “We have a very different vision of enhancing and expanding services,” he added, cautioning that if the union’s proposals aren’t put into action there’ll be more job losses and shifts into low-wage work.

To support its proposals, the union is citing a report issued early last year by the Postal Service’s Office of Inspector General. The report made the case that the Postal Service is well positioned to provide affordable non-bank financial services to a portion of the population whose needs aren’t met by the traditional financial sector, and said the shift might ultimately translate into $8.9 billion in annual revenue.

While the union was vague about its proposals Thursday, the OIG report included suggestions such as bill payment services and prepaid “Postal Cards.” Users could load the cards with cash or paychecks and use them to make withdrawals, pay bills, or transfer money internationally, according to the report, which suggested integrating the cards with online and mobile technologies.

Another OIG suggestion for the Postal Service: Offer small, affordable loans that could save borrowers money by helping them avoid more expensive options such as payday loans. The OIG was careful to say, however, that it isn’t suggesting the Postal Service become a bank or “openly compete with banks.” Instead, the Postal Service could partner with banks to offer complementary services in addition to the financial services it already offers such as money orders and international money transfers, the OIG said in its report.

The talks mark the first time in four-and-a-half years that the union and management have bargained for a new agreement.

In addition to the union’s president, AFL-CIO President Richard Trumka and actor and activist Danny Glover took to the podium at Thursday’s event in support of the union.

via Union Pushes Post Office to Offer Financial Services – Washington Wire – WSJ.