Background

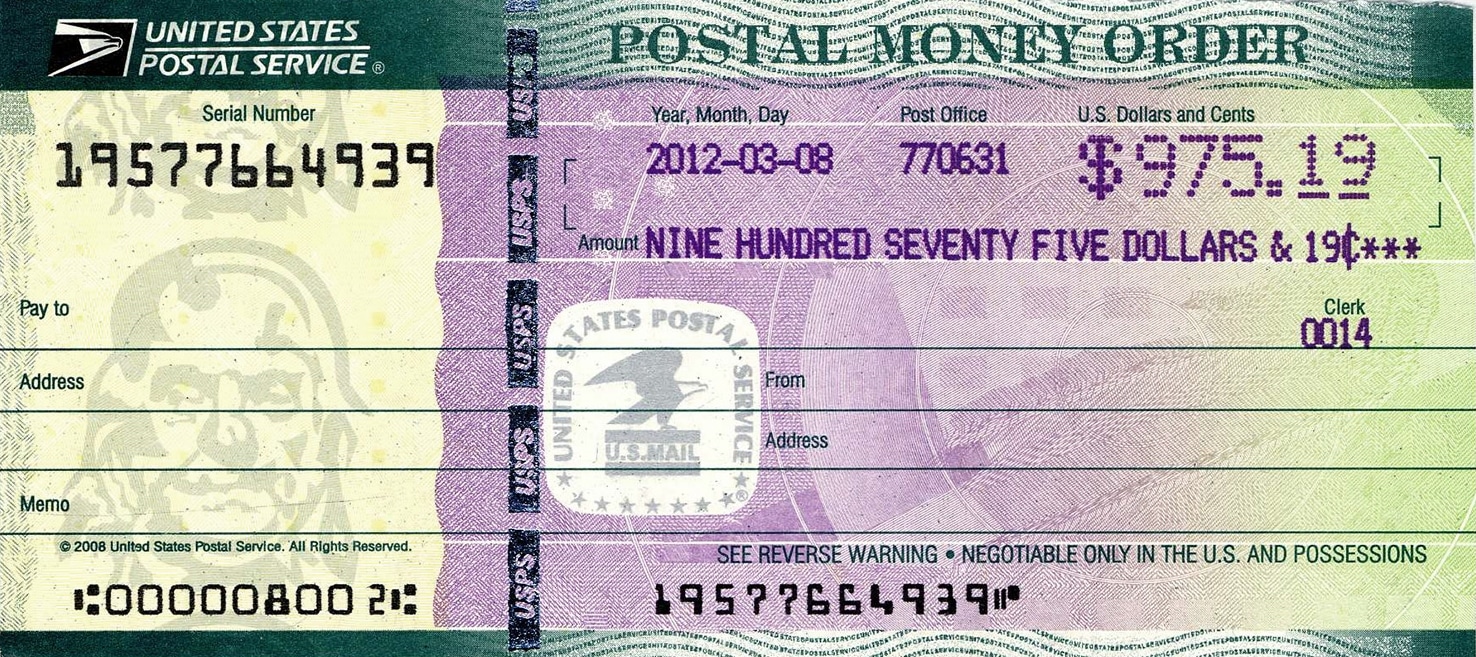

Office of Inspector General (OIG) uses tripwires to identify financial anomalies. Tripwires are analytic tools that look at specific behaviors and patterns that are strong indicators of improper activity. From October 1, 2015, to December 31, 2016, our tripwire identified the Kendall Green Station Contract Postal Unit (CPU), Washington, D.C., reported 262 money orders, valued at $71,512, as cashed prior to being reported as sold.

A CPU is a retail unit located inside a private business under contract with the Postal Service. It provides postal services to the public and is operated by non-postal employees. The Kendall Green Station CPU only provided money order services.

CPUs provide daily financial activity to the host post office at the close of business on the same business day. The host post office is responsible for verifying and transmitting the CPUs’ daily financial activities. This ensures all accounting transactions for the CPUs, including money order transactions, are included in the Postal Service’s financial systems.

The objective of this audit was to evaluate whether internal controls over money orders sold at the Kendall Green Station CPU were in place and effective.

What the OIG Found

Internal controls for money orders sold at the Kendall Green Station CPU needed improvement. We reviewed the accounting records from October 1, 2015, to December 31, 2016, and verified 262 money orders, valued at $71,512, were cashed prior to the host post office reporting them as sold. These money orders represented 53 percent of the 499 total money orders sold during the same period. The CPU manager did not deposit funds and submit the daily financial reports to the host post office on the day they were sold.

On March 7, 2017, we conducted an independent count of cash and money orders and identified a shortage of $5,305 for 21 money orders sold during February and March 2017. On the day of the count, the manager was not at work, so the CPU supervisor searched his safe, but the funds were not there. The manager provided the funds on the next business day and stated his supervisor overlooked them in the safe.

Also, the manager kept his personal money in the same safe with Postal Service funds. Further, the manager did not destroy 7,975 obsolete money orders, some dating back to 1998.

In addition, student employees overcharged customers for money order fees and entered incorrect purchase dates on the money orders.

The CPU manager stated he was aware of the proper procedures but did not follow them. The host post office supervisor stated she was not formally trained and adopted the practices of her predecessors who did not require the CPU manager to submit financial reports daily.

If controls over money orders are not followed, there is an increased risk of theft and inaccurate financial reporting.

We referred these issues to the OIG’s Office of Investigations for further review.

What the OIG Recommended

We recommended district management instruct the host post office to monitor money order sales and the financial reporting process at the Kendall Green Station CPU, provide CPU training to the host post office supervisor, and verify student employees are properly trained.

Full Report:

Source: USPS Office of Inspector General